Transitory Inflation: Wishful Thinking

Woke Crowd Shows no Sympathy for Mom & Pop, Peter Schiff and Mike Green Face Off

We’re seeing very substantial inflation. It’s very interesting. We’re raising prices. People are raising prices to us, and it’s being accepted.

— Warren Buffett, Berkshire Hathaway Annual Meeting May 1st, 2021

The debate about whether surges in commodity prices (lumber, iron, copper, etc), real estate, and other goods/services are transient rages. Here, a spirited discussion on that and related topics between Peter Schiff (Euro Pacific Capital) and Mike Green (Simplify Asset Management) that can give you a primer on some of the major economic opinions on these macro phenomena:

Though Schiff resorts to predictable Austrian Gold Bug one-liners, it’s still a valuable discussion given the prominence of the inflation/rate narrative today.

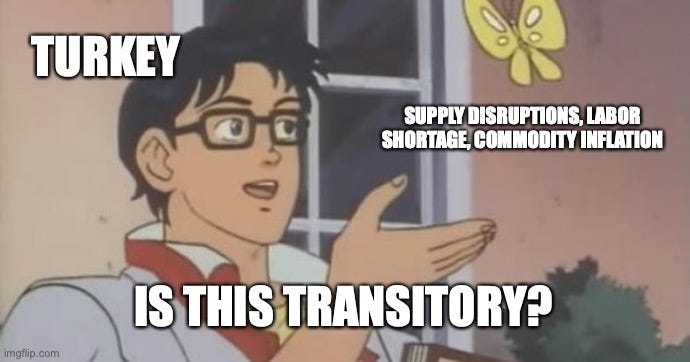

As we’ve discussed, given the non-linear risk profile of asset prices at low rates, one ought not to ignore the risk of inflation. But many instead choose to carry on like a Turkey:

Covid Was a Massively Deflationary Event

The pandemic was massively deflationary in that it crushed demand of various goods and services. Despite this, prices in many of these industries held steady thanks to unprecedented fiscal + monetary intervention:

Without unprecedented Fed corporate debt purchases, Ford and the Airlines were facing the cold shoulder from corporate credit markets. Some of these firms would have gone bankrupt and prices would have certainly fallen in a deflationary spiral in and around their industries (in fact, oil did go negative due to demand collapse, partly from airlines and autos); however, J Pow intervened and the rest is history...

The deflationary headwinds of pandemic induced shutdowns are now fading and instead, there may be tailwinds now emerging from consumers. As we noted, the Personal Savings Rate is near record highs. The question now is if this saved capital will remain on the sidelines in consumer checking/savings accounts as we reopen. We think not. We think consumer behavior has not fundamentally changed. What’s more is that many industries are struggling to rehire employees and restart/reramp production which will put upward pressure on prices.

We are already seeing inflationary signs and expect persistence as reopening progresses in the months ahead.

Kicking Small Businesses While They’re Already Down

If there’s one theme woke Twitter will reward, it’s looking out for workers. And these days, the woes of small businesses (hit by unprecedented events of last year) are easily dismissed by the woke, many of whom have had the luxury of maintaining their stable corporate jobs throughout the pandemic whilst working from home: