Begun, the Coin Wars Have

Bitcoiner Warns on Dogecoin (Unironically) // Did the SPAC Bubble Already Pop? Bloomberg is Throwing Shade at Chamath // Cboe Sells Shovels in the Gold Rush

A Redditor warns of the risks of Dogecoin in an upvoted r/cryptocurrency post that warns of the dangers of Doge while overlooking many of the same risks that exist with every other cryptocurrency:

With Dogecoin, you are buying hype.

If you buy doge, you are buying hype and Elon Musk tweet energy and nothing else.

Be careful.

This user may just be on the verge of self-awareness…

This is not the first time Bitcoiners have expressed disdain at Altcoiners, and each time it does provide some valuable entertainment…

Beware: Speculative Capital is Finite

The amount of capital that is available for speculative “Yolo” or other plays is finite. With the growing bubble across assets, the supply of assets for this capital is growing while demand is not (and may actually be shrinking)…

We are already seeing some bubbles pop (SPACs) while others rapidly inflate (Doge). Here is a front page Bloomberg story on “SPAC Jesus” Chamath Palihapitiya whose followers may be learning this the hard way:

We expect to see this with other inflated assets of recent times. $GME is a far cry from its high of over $300 and seems in a slow decline. And even at near record levels of Dogecoin prices, Bitcoin is selling off as certain Bitcoin investors with Paper Hands switch over to the newer, hotter play (see “Distracted Boyfriend” meme above)…

Eventually, the game of musical chairs will end as speculative capital shrinks through losses that build up in the carnage of bubbles popping, exacerbated by leverage. Speculative capital may already be shrinking as capital shifts into the real economy (and savings rate plunges) with reopening and without fresh stimulus checks to replenish it.

$CBOE: Sell Shovels During the Gold Rush

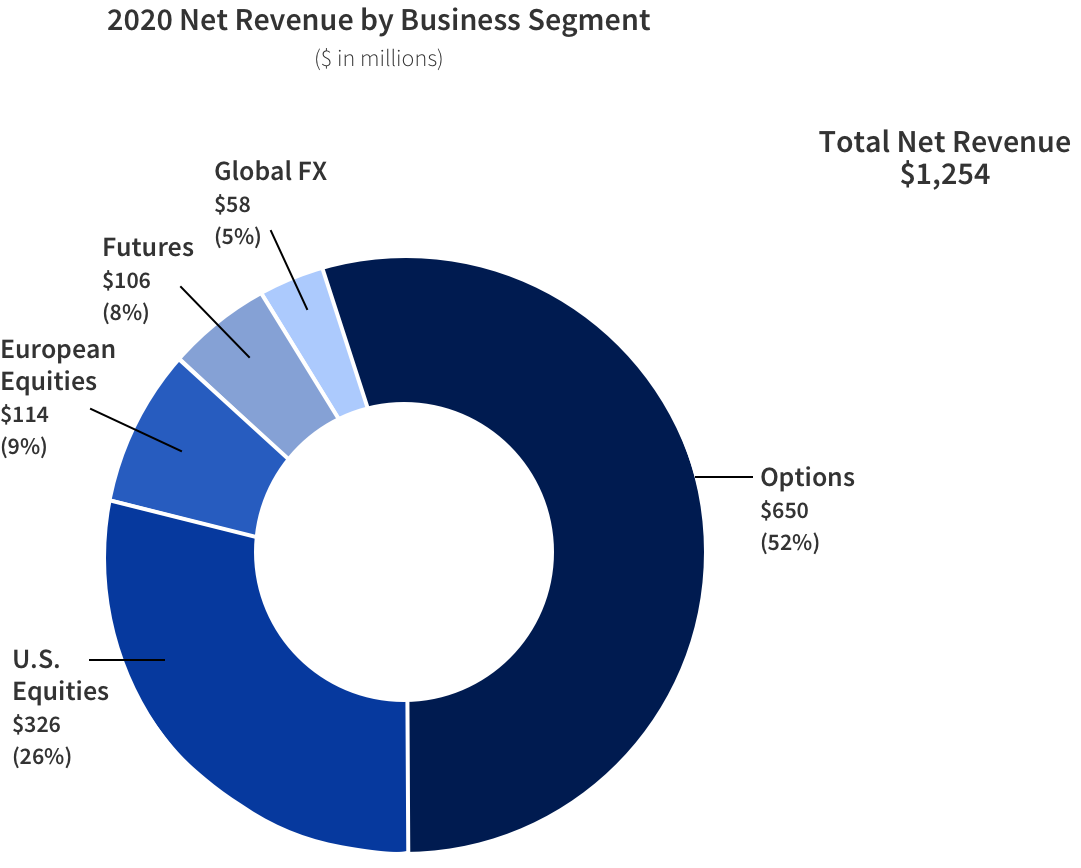

Cboe Global Markets ($CBOE), owner of the 2nd largest U.S. option exchange by volume, has been stuck in a rut despite the raging stonk (and options) market…

Here’s call option value trending up since early last year as platforms that (dangerously) “gamify” options trading like Robinhood surge in popularity…

Unless regulators step in hard, it’s hard to see how options volumes go back to where they were pre-2020 given retail’s newfound gambling addiction in options (again, thanks to Robinhood, et al.). Enter Cboe…

Multi-listed options are another source, big player in index options ($SPX). And let’s not forget some traders’ favorite vehicle to bet on: Cboe’s VIX. Oh yeah, and they own the BATS stock exchange.

While CBOE has sat still, $ICE, $NDAQ, $CME have surged lately…

In our view, CBOE is a potential bargain that may be worthy of further study…

(Disclosure: we are long $CBOE)

Bonus: Snowden NFT Sells for Over $5M

Look closer, however, and you'll find the image has been formed from the pages of a US appeals court decision that the Patriot Act did not permit mass collection and surveillance of Americans' phone records by the National Security Agency.

The proceeds will be reportedly donated, but nonetheless it tells you where our market is in speculator land…